Resources & Guides

Dovetail vs Proponent: Which One Fits Your Workflow?

Teams evaluating Dovetail and Proponent are usually dealing with a similar reality: qualitative insight is everywhere, but clarity is not. Interviews are being conducted, sales calls are recorded, feedback is captured across tools—but turning all of that raw input into decisions that consistently move outcomes becomes increasingly difficult as teams grow.

While both platforms work with customer voice, they are optimized for very different moments in how insight is generated and applied. Understanding those moments—rather than comparing features in isolation—is what ultimately makes the choice between them clearer.

Why Teams Compare Dovetail and Proponent

Both handle qualitative customer insight

At a foundational level, both tools exist to help teams make sense of unstructured data: conversations, notes, transcripts, and feedback that don’t fit neatly into dashboards or spreadsheets. As organizations mature, qualitative insight becomes just as important as quantitative metrics for guiding product, marketing, and GTM decisions.

Because both Dovetail and Proponent sit in this qualitative layer, they often appear interchangeable during early evaluation—even though the type of insight they surface, and the way it’s meant to be used, differs significantly.

Confusion starts when teams scale beyond interviews

The comparison typically emerges when teams move past a small number of interviews or calls. Informal note-taking stops working. Insights become fragmented. Different teams hear different “truths” from customers. At this stage, the challenge isn’t collecting more feedback—it’s deciding which insight should influence which decision, and at what point in time.

That’s where teams start looking for platforms that promise structure, scale, and clarity—and where Dovetail and Proponent enter the same conversation.

When Dovetail Is the Right Choice

Structured qualitative research

Dovetail is built for teams running formal qualitative research. This includes discovery interviews, usability tests, diary studies, and exploratory research where methodological rigor matters. It enables teams to systematically tag data, synthesize themes, and trace insights back to original sources.

This approach is especially valuable when insights need to be defensible, reviewed across stakeholders, and used to inform foundational decisions such as product direction, UX improvements, or long-term positioning.

Long-term research repositories

Another strength of Dovetail is its role as a durable research repository. Over time, teams can accumulate studies, revisit historical findings, and build institutional memory around customer needs and behaviors. This makes it easier to avoid relearning the same lessons repeatedly as teams change or scale.

In short, Dovetail excels when insight depth, continuity, and traceability matter more than immediacy.

When Proponent Is the Right Choice

Insight from sales and GTM conversations

Proponent is designed for a different source of insight: live buyer conversations that happen during go-to-market execution. These include sales calls, demos, renewals, and ongoing customer discussions—moments where buyers articulate concerns, urgency, and internal dynamics in their own words.

Unlike structured research, these conversations are continuous and high-volume. They reflect what buyers care about right now, not what they reported during a planned study weeks or months earlier.

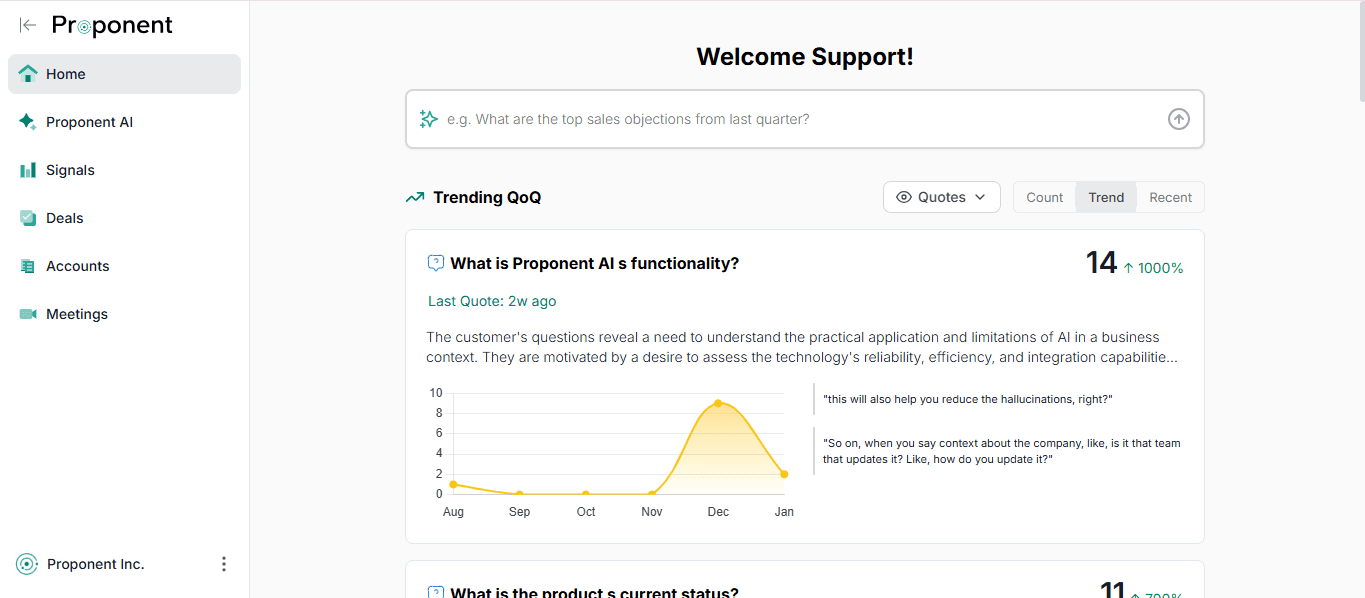

Real-time signals for execution

Proponent’s value comes from identifying patterns across these conversations at scale. Instead of relying on memorable anecdotes from a single call, teams can see recurring objections, shifts in buyer language, and early signals of hesitation or momentum across accounts.

Because this insight surfaces while deals are still active, it can directly inform messaging tweaks, enablement updates, and positioning adjustments within the same quarter—when those changes still have leverage.

Key Differences at a Glance

Timing of insight

Dovetail surfaces insight after research is completed, synthesized, and shared. This timing is well suited for deliberate planning and long-term decisions. Proponent surfaces insight while conversations are still unfolding, allowing teams to influence outcomes before they’re locked in.

Type of output

Dovetail produces structured research artifacts such as themes, reports, and documented findings. Proponent produces behavioral signals—patterns that indicate how buyers are thinking, where they’re getting stuck, and why decisions are moving or stalling. Both outputs are valuable, but they serve different purposes.

Which One Should You Choose?

Choose based on the decision you’re supporting

If your primary questions are “What problems should we prioritize?”, “How do users experience this workflow?”, or “What themes emerge across studies?”, Dovetail is a strong fit. If your questions are “Why are deals slowing down?”, “What objections are showing up this month?”, or “How should we adjust messaging mid-quarter?”, Proponent is designed for that context.

Many teams use both

In practice, many teams don’t treat this as an either-or decision. Research platforms inform long-term strategy and foundational understanding. Conversation intelligence tools shape execution and day-to-day judgment. Used together, they help teams avoid reacting too late or relying on isolated anecdotes.

Final Takeaway

Dovetail and Proponent are not substitutes. They are optimized for different moments in the insight lifecycle and support different kinds of decisions.

Teams run into trouble when they expect a single tool to handle both deliberate research and live GTM insight. Clarity comes from matching tools to timing—not from forcing overlap.

The best teams don’t ask, “Which tool is better?”

They ask, “What decision am I trying to support right now?”